What are Kenya’s travel restrictions?

November 20, 2025

Is Kenya good for solo travelers?

November 20, 2025What’s the best travel insurance for safaris?

What’s the Best Travel Insurance for Safaris?

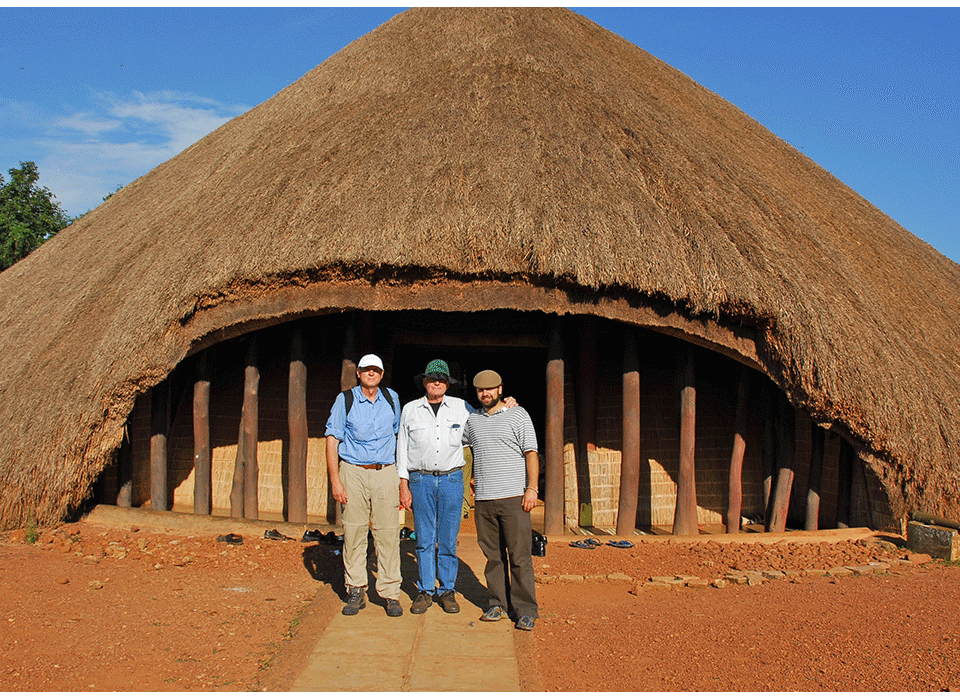

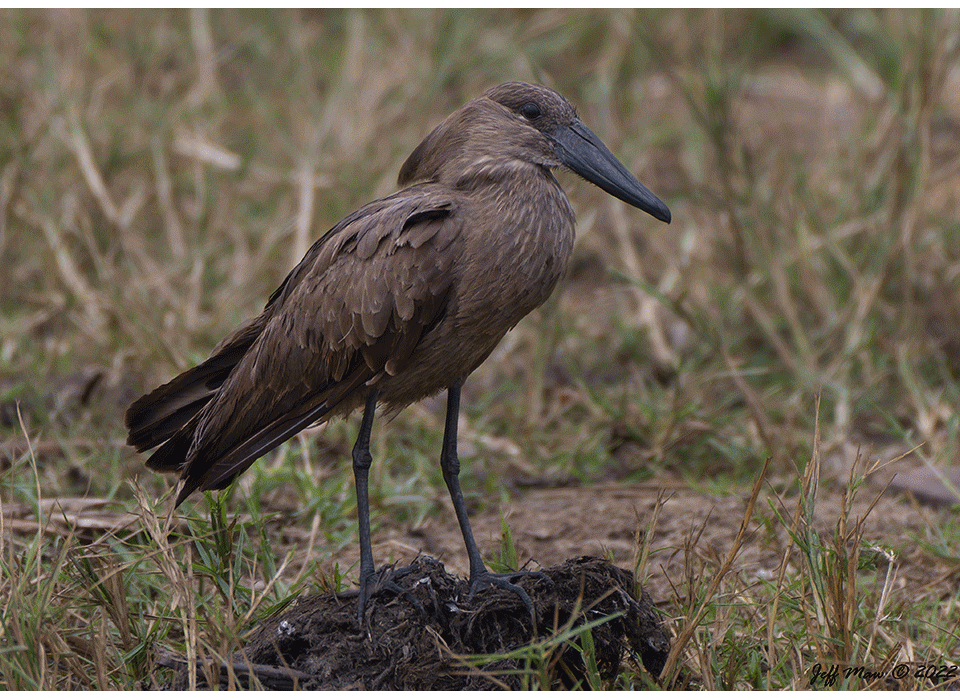

Embarking on a safari is one of the most exciting adventures in the world. Whether you’re tracking lions across the Maasai Mara, exploring the rolling plains of Serengeti, trekking for gorillas in Uganda, or drifting through the wetlands of the Okavango Delta, safaris bring you face-to-face with nature in its purest form. But with adventure comes unpredictability—wildlife encounters, rugged terrain, remote locations, and long travel distances. Because of this, having the right travel insurance for safaris is essential.

Safari destinations—while breathtaking—are often far from major cities and medical facilities. You may be traveling by light aircraft, 4×4 vehicles, boats, or trekking through dense forests. Unexpected weather changes, airline delays, lost luggage, sudden illness, injuries, or evacuation needs can disrupt your journey. Choosing the best travel insurance ensures peace of mind and protects you from unexpected costs.

This detailed guide explains everything you need to know about the best travel insurance for safaris: what to look for, key coverage areas, common mistakes travelers make, recommended policy types, and why safari-specific insurance is different from regular travel insurance.

Why Safari Travelers Must Have Strong Travel Insurance

Safaris take place in remote areas, far from standard medical resources. Even the most luxurious camps are usually located several hours from hospitals. In places like Maasai Mara, Serengeti, Kruger, Amboseli, or South Luangwa, evacuation may require a charter flight or air ambulance.

Here’s why travel insurance is non-negotiable for safari travelers:

Wildlife encounters may pose risks

Terrain can be rugged, rocky, or slippery

Medical evacuation can be extremely expensive

Safari travelers often use bush flights that can be delayed due to weather

Gear such as cameras and binoculars is valuable and needs protection

Unexpected illnesses—food-related or environmental—may occur

Travel disruptions are more common in remote areas

Luggage can be lost during connecting flights

Regular travel insurance often fails to cover these specific safari-related risks. Therefore, choosing the right policy is crucial.

What the Best Safari Travel Insurance Should Cover

Not all travel insurance plans are created equal. When planning a safari, you need a policy tailored to adventure travel, remote locations, and wildlife environments. Below are the essentials your insurance must include.

Emergency Medical Coverage

This is the most important part of safari insurance. You should look for:

Coverage of at least $100,000 for medical expenses

Higher limits if traveling to multiple countries

Coverage for injuries related to wildlife, trekking, or bush activities

Safari destinations often involve uneven ground, insects, and long exposure hours—so comprehensive medical coverage is vital.

Emergency Evacuation and Repatriation

Air evacuation from remote wilderness areas can cost tens of thousands of dollars. Your policy must include:

Emergency helicopter evacuation

Air ambulance for international transfers

Bush-flight evacuation from safari camps

Repatriation to your home country

This ensures you’re safely transported to a medical facility if needed.

Trip Cancellation and Interruption

The best policies cover cancellations caused by:

Illness before travel

Family emergencies

Unexpected weather events

Airline strikes

Natural disasters

Political instability

These ensure you get refunds for prepaid safaris, lodges, and flights.

Lost, Delayed, or Damaged Luggage

Safari travelers often carry expensive items such as:

DSLR cameras

Binoculars

Lenses

Drones (if legally permitted)

Safari clothing and gear

Insurance should cover loss, theft, or delay of luggage.

Coverage for Adventure Activities

Safari experiences may include:

Walking safaris

Gorilla trekking

Horseback safaris

Hot air balloon rides

Boat safaris

Canoeing

Hiking

Make sure your insurance specifically includes adventure coverage. Some standard plans exclude activities considered “risky,” so check the fine print.

Safari Photography Equipment Coverage

Photographers often bring gear worth thousands of dollars. Ensure your policy covers:

Cameras

Lenses

Memory cards

Tripods

Drones (if allowed)

Laptop or editing devices

High-value item add-ons may be required.

Travel Delay Compensation

Delays on small bush flights or inter-city transfers can happen due to:

Fog in Mara airstrips

Heavy rains

Vehicle breakdowns

Road closures

A strong policy compensates you for missed nights, meals, and additional travel arrangements.

Optional Add-Ons Safari Travelers May Need

Some safari travelers benefit from additional specialized coverage:

Cancel For Any Reason (CFAR)

Allows you to cancel your trip for personal reasons not listed in the policy.

Adventure Sports Coverage

For hot air balloon safaris, zip-lining, or extreme excursions.

Pre-Existing Medical Condition Waivers

If you have any medical history, choose a policy that allows a waiver for pre-existing conditions.

Rental Car Protection

Especially useful for self-drive safaris in Kenya, Namibia, Uganda, or South Africa.

Personal Liability Coverage

In case you cause accidental damage in lodges or rental camps.

Common Mistakes Travelers Make When Buying Safari Insurance

Common Mistakes Travelers Make When Buying Safari Insurance

Many travelers assume standard travel insurance is enough, but safaris are unique journeys that require enhanced coverage. Here are common mistakes to avoid:

Not checking evacuation limits

Choosing the cheapest plan instead of the most comprehensive

Forgetting to add adventure activity coverage

Failing to declare pre-existing health conditions

Not insuring expensive camera equipment

Overlooking coverage for small connecting flights

Assuming medical insurance at home covers international travel

Understanding these potential pitfalls helps you select a strong and dependable policy.

When to Buy Safari Travel Insurance

It’s best to buy insurance as soon as you book your safari, especially if you want cancellation protection. This ensures you’re covered in case something unexpected happens before your trip.

If you wait until the last minute, you may:

Lose eligibility for cancellation coverage

Risk your policy excluding pre-existing conditions

Miss add-ons that must be purchased early

Planning ahead pays off.

How to Choose the Best Travel Insurance Provider for Safaris

When comparing policies, look for the following traits:

Strong reputation

Clear terms and exclusions

High medical and evacuation limits

Comprehensive adventure coverage

Positive customer reviews

24/7 global support

Fast emergency response

Coverage for multiple African countries

Flexible cancellation options

Different travelers may need different types of plans depending on age, itinerary, activities, and gear.

Why Safari Travel Insurance Is Different From Standard Travel Insurance

Safaris involve unique risks:

Remote locations

Wild animals

Bush planes

Outdoor activities

Variable weather

Challenging terrain

Standard travel insurance often focuses on urban or resort travel and may not include remote evacuation or wildlife-related injuries. Safari insurance must be stronger, more flexible, and capable of responding to emergencies far from major cities.

Tips for Making a Claim Smoothly

Keep copies of:

Receipts

Lodge bookings

Medical reports

Evacuation documentation

Police reports (if applicable)

Report incidents immediately and maintain communication with your insurer. This ensures smooth reimbursement and faster processing.

Why Using a Safari Tour Operator Helps With Insurance

Professional safari companies understand the realities of bush travel and will guide you on which insurance requirements are essential for your specific itinerary. They know the areas you’re visiting, the activities you’ll be doing, and what level of coverage is appropriate. They can also help during emergencies by coordinating evacuation, contacting insurance providers, and organizing documentation.

A safari is one of the most rewarding travel experiences on earth—and proper travel insurance ensures your adventure remains safe, secure, and worry-free. From medical evacuation to wildlife injuries, camera protection to bush-plane delays, choosing the best safari insurance gives you peace of mind in every situation.

Planning a safari can be complex, but with expert support, the experience becomes effortless and enriching. Experiya Tour Company helps travelers arrange unforgettable safari journeys, providing personalized guidance, safety support, transport, accommodation, and recommendations—including which travel insurance suits your itinerary.

For a seamless, well-organized, and secure safari experience, booking your travel with Experiya Tour Company is highly recommended.